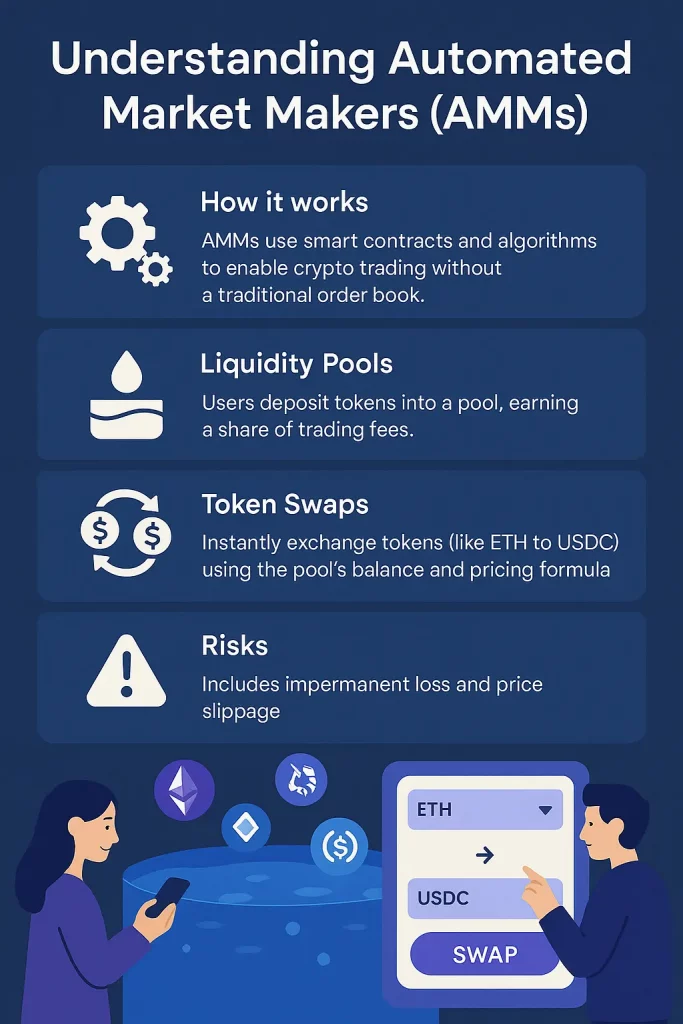

What is an Automated Market Maker?

You want to trade a lesser-known cryptocurrency but find no buyers or sellers on a centralized exchange. Automated Market Makers (AMMs) solve this problem by enabling decentralized, permissionless trading through liquidity pools and algorithms. As a core component of decentralized finance (DeFi), AMMs allow you to swap tokens directly with a smart contract, bypassing traditional order books. Unlike centralized exchanges, which rely on matching buyers and sellers, AMMs use community-funded liquidity pools to ensure constant trading availability. For instance, platforms like Uniswap facilitate over $1.7 trillion in trading volume by mid-2024, highlighting their significance. By depositing tokens into these pools, you can become a liquidity provider and earn fees, democratizing market-making in the crypto ecosystem.

How AMMs Work

When you trade on an AMM, you interact with a liquidity pool containing pairs of tokens, such as ETH and USDT, managed by a smart contract. The most common pricing mechanism is the constant product formula, x * y = k, where x and y represent the quantities of two tokens, and k remains constant. For example, in a pool with 100 ETH and 10,000 USDT (k = 100 * 10,000 = 1,000,000), if you add 10 ETH, the pool adjusts to 110 ETH and approximately 9,090.91 USDT (1,000,000 / 110), giving you about 909.09 USDT. This dynamic pricing ensures liquidity but adjusts prices based on supply and demand. AMMs like Uniswap charge a 0.3% fee per trade, distributed to liquidity providers. Smart contracts automate these processes, ensuring trustless and transparent trading on blockchains like Ethereum.

Benefits

AMMs offer several advantages that make them appealing for your trading needs:

Decentralization: Operating on blockchains, AMMs eliminate intermediaries, giving you control over your assets without centralized risks.

Accessibility: Anyone with a crypto wallet can trade or provide liquidity, with no KYC requirements, making AMMs inclusive globally.

Continuous Liquidity: Pools ensure you can trade 24/7, even for niche tokens, unlike centralized exchanges with limited order books.

Lower Fees: AMMs typically charge fees like 0.3% (e.g., Uniswap), often lower than centralized platforms, saving you money.

Transparency: Public algorithms let you predict trade outcomes, reducing surprises from hidden fees or slippage.

Niche Token Support: AMMs enable trading for tokens not listed on centralized exchanges, fostering innovation.

Permissionless Listing: If you’re a project creator, you can list tokens instantly, bypassing lengthy exchange processes.

Examples of AMMs

Several AMM platforms stand out in the DeFi space, each with unique features to suit your needs

| Platform | Blockchain | Key Features | Native Token |

|---|---|---|---|

| Uniswap | Ethereum | Uses constant product formula; supports ERC-20 tokens; V3 offers concentrated liquidity | UNI |

| SushiSwap | Ethereum, Polygon | Fork of Uniswap with yield farming and governance features | SUSHI |

| PancakeSwap | Binance Smart Chain | Low fees, fast transactions, IFOs, and gamified elements like lotteries | CAKE |

| Balancer | Ethereum | Multi-asset pools with customizable ratios for flexible trading strategies | BAL |

Types of AMMs

| Type | Formula/Mechanism | Examples | Use Case |

|---|---|---|---|

| Constant Product Market Maker | x * y = k | Uniswap, SushiSwap | General token pairs, broad liquidity |

| Stablecoin-Focused AMM | Bonding curve for low volatility | Curve Finance | Stablecoin trading, low slippage |

| Multi-Asset Pool AMM | Custom ratios for multiple tokens | Balancer | Flexible, complex trading strategies |

| Concentrated Liquidity AMM | Liquidity in specific price ranges | Unis Ascend, mySwap | Capital-efficient liquidity provision |

Constant Product Market Makers (CPMMs): Use x * y = k for pricing, suitable for most token pairs but prone to slippage.

Stablecoin-Focused AMMs: Curve Finance uses a bonding curve to minimize slippage for stablecoin trades, ideal for low-volatility assets.

Multi-Asset Pool AMMs: Balancer supports pools with multiple tokens, offering flexibility for liquidity providers.

Concentrated Liquidity AMMs: Uniswap V3 and mySwap let you focus liquidity in specific price ranges, increasing efficiency but requiring active management.

Choosing the right AMM depends on your goals, whether trading stablecoins or providing liquidity for niche tokens.

The Future of AMMs

As you explore DeFi, AMMs are set to evolve with these trends and challenges

Scalability: High Ethereum gas fees are pushing AMMs toward layer 2 solutions like Optimism, reducing costs and improving speed.

Cross-Chain Integration: Future AMMs may enable trading across blockchains, enhancing liquidity access across ecosystems.

Regulatory Scrutiny: Increased oversight may introduce KYC/AML requirements, potentially affecting decentralization but attracting institutional investors.

Broader Asset Support: AMMs could expand to include NFTs or real-world assets, requiring tokenization advancements.

Security Enhancements: With hacks targeting AMM pools, future platforms may adopt formal verification and multi-signature governance.

Impermanent Loss Mitigation: Dynamic fees or insurance could reduce risks for liquidity providers.

Front-Running Protection: Mechanisms like transaction ordering may combat manipulation.

User Experience: Improved interfaces and resources will make AMMs more accessible.

AMMs are poised for growth, but addressing these challenges will be crucial for their long-term success in DeFi.