NFT Slang Guide 2025: Key NFT Terms, Acronyms & Meanings

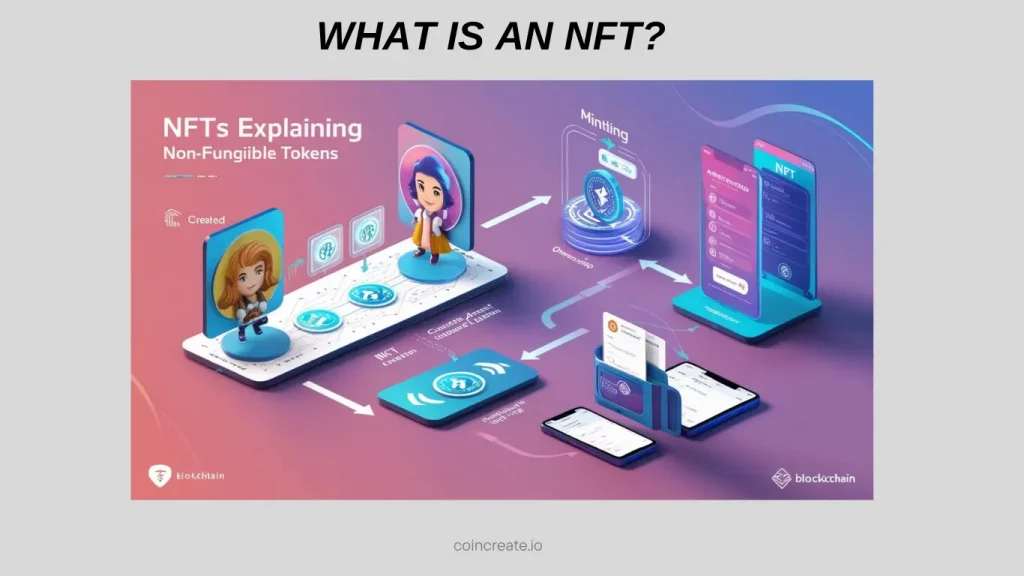

If you’re diving into the world of Non-Fungible Tokens (NFTs), you’ve likely stumbled across a whirlwind of jargon that feels like a foreign language. Terms like “minting,” “gas fees,” “floor price,” and “apeing” pop up in Discord chats, X posts, and Reddit threads, leaving newcomers scratching their heads. Don’t worry—you’re not alone. The NFT community has developed a vibrant, unique lexicon that blends technical blockchain terms with playful slang, memes, and abbreviations. Understanding this lingo isn’t just about fitting in; it’s about unlocking the culture, trends, and opportunities in the NFT space.

In this comprehensive guide, you’ll learn the essential NFT slang and terminology you need to navigate this dynamic ecosystem with confidence. Whether you’re an artist minting your first digital collectible, a collector hunting for the next big drop, or an investor eyeing blue-chip projects, this article will arm you with the knowledge to engage, trade, and thrive in the NFT world. Let’s break it down, term by term, so you can talk the talk and walk the walk.

Why NFT Slang Matters

Before you jump into the glossary, let’s address why learning NFT slang is worth your time. The NFT space moves fast—new projects launch daily, trends shift in hours, and communities form around shared language and culture. Knowing the lingo helps you:

- Stay Informed: Terms like “alpha” and “FOMO” signal market trends and opportunities.

- Connect with the Community: Slang like “GM” and “fren” fosters camaraderie and helps you build relationships.

- Avoid Pitfalls: Understanding terms like “rug pull” can protect you from scams.

- Make Smart Moves: Grasping concepts like “floor price” and “gas wars” empowers you to trade strategically.

Think of NFT slang as your passport to a global, decentralized community. It’s not just jargon—it’s the heartbeat of a cultural and financial revolution. Ready to decode it? Let’s go.

Core NFT Terminology - The Essentials

These foundational terms are the backbone of NFT conversations. Master them, and you’ll understand the mechanics of the ecosystem.

NFT (Non-Fungible Token)

An NFT is a unique digital asset stored on a blockchain, typically Ethereum, Solana, or Polygon. Unlike cryptocurrencies like Bitcoin, which are fungible (interchangeable), NFTs are one-of-a-kind, representing ownership of digital art, music, virtual real estate, or collectibles. When you buy an NFT, you’re purchasing a digital certificate of authenticity, verifiable on the blockchain.

Example: You mint a CryptoPunk NFT, and its metadata proves you own that specific pixelated avatar—no one else can claim it.

Minting

Minting is the process of creating an NFT by publishing a digital file (like an image or video) to a blockchain. It’s like stamping a coin, making the asset verifiable and tradable. You’ll often hear about “mint dates” for new NFT collections.

Example: You upload your digital artwork to OpenSea and pay a gas fee to mint it as an NFT.

Gas Fees

Gas fees are the costs you pay to process transactions on a blockchain, like Ethereum. These fees compensate miners for the computational power needed to validate and record your transaction. Gas prices fluctuate based on network demand, spiking during popular NFT drops.

Example: You try to mint an NFT during a hyped launch, but the gas fee shoots up to $100 due to network congestion.

Floor Price

The floor price is the lowest price at which an NFT from a collection is listed for sale on a marketplace like OpenSea. It’s a key indicator of a project’s value and popularity. A rising floor price signals demand, while a falling one may suggest waning interest.

Example: The floor price for Bored Ape Yacht Club NFTs is 50 ETH, meaning you can’t buy one for less than that.

Blockchain

A blockchain is a decentralized, tamper-proof digital ledger that records NFT ownership and transactions. Ethereum is the most popular blockchain for NFTs, but others like Solana and Tezos are gaining traction due to lower gas fees.

Example: Your NFT’s ownership is recorded on Ethereum’s blockchain, ensuring it can’t be duplicated or forged.

Trading and Investment Slang

NFTs are as much about trading and investing as they are about art. These terms will help you navigate the market like a pro.

Ape/Apeing

To “ape” into an NFT project means buying in quickly, often impulsively, without thorough research, driven by hype or FOMO (Fear of Missing Out). The term comes from the “apes together strong” meme, symbolizing collective enthusiasm.

Example: You aped into a new NFT collection because everyone on X was hyping it, but you didn’t check the team’s credentials.

Diamond Hands

If you have “diamond hands,” you hold onto your NFTs despite price dips, FUD (Fear, Uncertainty, Doubt), or market volatility, believing in their long-term value. It’s a badge of conviction.

Example: Despite a market crash, you diamond-hand your CryptoPunk, confident it’ll rebound.

Paper Hands

The opposite of diamond hands, “paper hands” describes someone who sells their NFTs quickly, often at a loss, due to panic or short-term price drops. It’s used as a playful jab.

Example: You sold your NFT for 0.5 ETH when the price dipped, only to see it soar to 2 ETH—classic paper hands move.

Flip/Flipping

Flipping is buying an NFT at a low price (often during minting) and selling it quickly for a profit on the secondary market. It’s a high-risk, high-reward strategy.

Example: You minted an NFT for 0.1 ETH and flipped it for 1 ETH on OpenSea the next day.

Whale

A “whale” is an individual or entity holding a large number of NFTs or cryptocurrency, often influencing market prices with their trades. Whales can make or break a project’s momentum.

Example: A whale buys 10 NFTs from a collection, pushing the floor price up overnight.

Alpha

Alpha refers to insider information or valuable tips about upcoming NFT projects or market trends. Getting “alpha” can give you an edge, but it’s often shared in exclusive Discord groups or X circles.

Example: Your friend in a private Discord shares alpha about a new project with a strong team, prompting you to mint early.

FOMO

Fear of Missing Out drives many NFT purchases, especially during hyped drops. FOMO can lead to impulsive buys, so always DYOR (Do Your Own Research).

Example: You bought an NFT at a high price because you had FOMO during a gas war, only to see the project fizzle out.

DYOR

“Do Your Own Research” is a reminder to investigate a project’s team, roadmap, and community before investing. It’s often paired with “NFA” (Not Financial Advice) to emphasize personal responsibility.

Example: A project looks promising, but you DYOR and discover the team has a history of rug pulls.

Community and Culture

The NFT community thrives on shared culture, memes, and positivity. These terms reflect the social side of the space.

GM/GN

“GM” (Good Morning) and “GN” (Good Night) are friendly greetings NFT enthusiasts use on X and Discord to build community spirit. They’re a daily ritual for many.

Example: You tweet “GM fam!” and get dozens of replies from your NFT frens.

Fren

A “fren” is a friend or buddy in the NFT community. It’s a playful, inclusive term that reflects the camaraderie of the space.

Example: You thank a fren on Discord for sharing alpha about a new drop.

WAGMI/NGMI

“WAGMI” (We’re All Gonna Make It) is an optimistic rallying cry, expressing hope that everyone in the NFT space will succeed. Conversely, “NGMI” (Not Gonna Make It) is a tongue-in-cheek jab at those making poor decisions.

Example: You tweet “WAGMI!” to celebrate a project’s success, but call someone NGMI for selling their NFT at a loss.

LFG

“Let’s F***ing Go” is a high-energy phrase used to express excitement about a project, drop, or market surge. It’s pure hype fuel.

Example: You shout “LFG!” in a Discord chat when your favorite project announces a major partnership.

Rug Pull

A “rug pull” is a scam where developers hype an NFT project, collect funds during minting, and then disappear, leaving investors with worthless tokens. Always DYOR to avoid rugs.

Example: You minted an NFT, but the team deleted their X account and vanished—yep, it was a rug pull.

Advanced Concepts - Level Up Your Knowledge

Ready to go deeper? These terms cover more complex NFT mechanics and strategies.

Airdrop

An airdrop is when a project distributes free NFTs or tokens to wallet holders, often to reward early supporters or boost visibility. Airdrops can create buzz and drive demand.

Example: You hold an NFT from a project, and they airdrop a bonus token to your wallet as a thank-you.

Burn

To “burn” an NFT means to permanently remove it from circulation by sending it to an inaccessible wallet. Burning increases scarcity, potentially raising the value of remaining NFTs.

Example: A project burns 1,000 unsold NFTs to make the collection rarer, boosting its floor price.

DAO

A Decentralized Autonomous Organization (DAO) is a community-run entity governed by smart contracts on the blockchain. Many NFT projects use DAOs to give holders voting rights on project decisions.

Example: You own an NFT from a DAO-based project, so you vote on how the community treasury is spent.

Blue Chip

Blue-chip NFTs are stable, high-value projects with strong communities and consistent growth, like CryptoPunks or Bored Ape Yacht Club. They’re seen as safe, long-term investments.

Example: You invest in a blue-chip NFT, knowing its value is likely to hold steady over time.

Gas War

A gas war happens when many people compete to mint NFTs during a popular drop, driving up gas fees as they outbid each other to secure a transaction. It’s chaotic and costly.

Example: You try to mint a hyped NFT, but the gas war pushes fees to $300, forcing you to wait.

Open Edition

Unlike limited-edition NFTs, open-edition NFTs allow buyers to mint unlimited copies within a set timeframe. They’re less exclusive but can still gain value based on demand.

Example: You mint an open-edition NFT during a three-minute window, joining thousands of others.

Tips to Stay Ahead in the NFT Space

Now that you’re fluent in NFT slang, here are some tips to leverage your knowledge:

- Join Communities: Engage on Discord, X, and Reddit to stay updated on alpha and trends.

- Monitor Floor Prices: Use platforms like OpenSea or LooksRare to track project performance.

- Set Gas Budgets: Plan for gas fees during drops to avoid overspending in gas wars.

- DYOR Always: Research teams, roadmaps, and community sentiment before minting or buying.

- Embrace the Culture: Use GM, LFG, and WAGMI to connect with frens and build your network.

Your Journey Starts Here

The NFT world is equal parts art, tech, and community, and its slang reflects that vibrant mix. By mastering these terms, you’re not just learning words—you’re unlocking a culture that’s reshaping how we create, own, and trade digital assets. Whether you’re minting your first NFT, diamond-handing a blue-chip, or dodging rug pulls, this glossary is your guide to thriving in the space.

So, go forth, fren. Mint wisely, hold strong, and shout “WAGMI!” as you navigate the wild, wonderful world of NFTs. The blockchain is waiting for you—LFG.