What is a Bear Trap? How to Identify and Avoid It

A bear trap is a sneaky market move that tricks traders into thinking prices will keep falling, triggering panic selling — only for the price to suddenly reverse and surge higher. Many traders end up caught off guard, facing unexpected losses because they acted on this false signal. Often, big players or “whales” manipulate prices to create this misleading bearish scenario, profiting at the expense of smaller traders who sell too soon.

Relevance in Trading

Understanding bear traps is crucial for traders as they can significantly impact trading strategies and outcomes. Recognizing these patterns helps traders:

- Avoid premature selling.

- Make informed decisions based on market signals rather than reacting impulsively to short-term price movements.

Bear traps highlight the importance of:

- Technical analysis.

- Market psychology.

Key Concepts

- Market Signals: Traders often rely on various signals to make decisions. A bear trap represents a false signal that can lead to significant losses if not identified correctly.

- Short Selling: During perceived downtrends, many traders engage in short selling. However, bear traps can cause unexpected losses when the market reverses.

- False Signals: Bear traps exemplify how misleading signals can distort trader behavior, highlighting the need for caution and thorough analysis before executing trades.

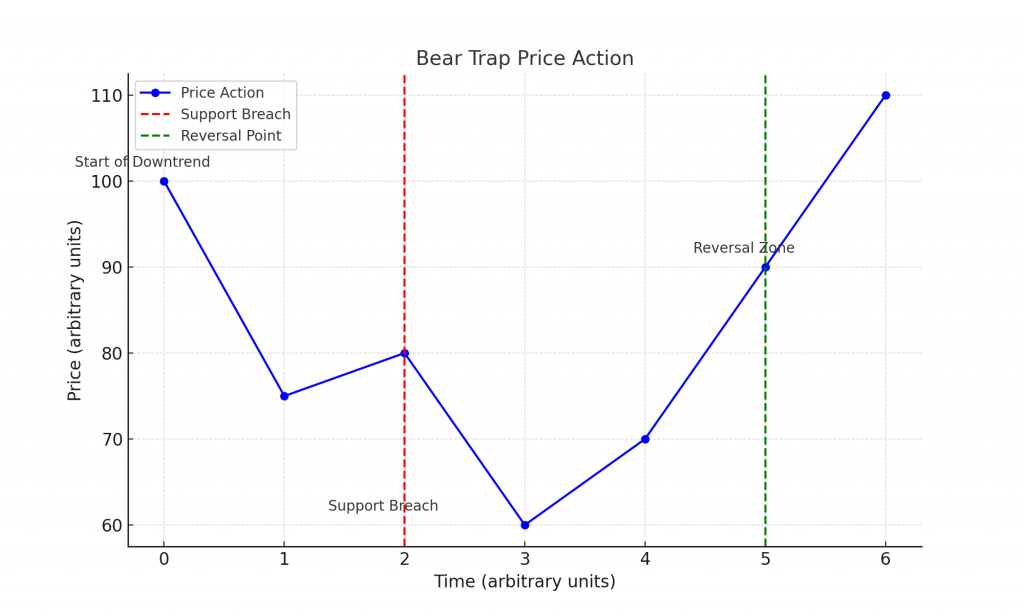

How a Bear Trap Works

Step-by-Step Explanation of Bear Trap Creation:

- Initial Downward Movement: A financial asset experiences a decline in price, often following a significant upward rally. This decline may be triggered by market sentiment or external news that creates fear among traders.

- Increased Selling Pressure: Institutional traders or large market players initiate a sell-off to push the asset’s price down further, creating the illusion of a bearish trend.

- Breaking Support Levels: As the price drops, it may breach key support levels, generating additional panic among traders who fear further declines. This often leads to an increase in short selling.

- Market Manipulation: Once the price reaches a certain low point, the same market players who initiated the sell-off begin to buy back the asset at these artificially low prices. This influx of buying activity increases demand and drives the price back up.

- Price Reversal: As the price begins to rise, traders who shorted the asset are forced to cover their positions to prevent further losses. This additional buying pressure accelerates the price recovery, completing the bear trap cycle.

Examples from Stocks and Crypto

During the extreme volatility of May 2021, Bitcoin plunged sharply from nearly $65,000 to about $30,000, causing panic selling. However, in the following weeks, the price bounced back above $40,000, trapping many who sold early. Similarly, the January 2021 GameStop short squeeze showed sharp rallies that caught short sellers off guard, marking classic bear trap scenarios. These real events highlight how traders can be misled by sudden price drops before rapid recoveries.

Analyzing Price Movements and Trader Reactions

Bear traps exploit trader psychology by creating false signals that lead to impulsive decisions. Key tools for identifying bear traps include:

- Candlestick Patterns: For example, a bearish engulfing pattern followed by a bullish reversal candle may indicate that the downward trend was temporary.

- Market Indicators: Tools like RSI or MACD can signal potential reversals.

- Trend Reversal Signals: Look for confirmation signals, such as price closing above previous resistance levels or bullish candlestick patterns.

Identifying Bear Traps

Technical Analysis Tools and Patterns

- Support and Resistance Levels:

- Identify key support levels where the price has historically bounced back. A break below these levels followed by a rapid recovery can indicate a bear trap.

- Candlestick Patterns:

- Look for bullish reversal patterns, such as hammers, inverted hammers, and engulfing patterns, that form after a price drop.

- Technical Indicators:

- Use RSI to identify oversold conditions.

- Look for bullish MACD crossovers after a price drop.

- Volume Analysis:

- Carefully analyze trading volumes during price drops. If price breaks below support on low volume, it suggests weak selling pressure and a possible bear trap forming. Conversely, high volume confirms strong bearish momentum. For example, when volume decreases sharply during a price decline but price quickly reverses, it signals that the drop lacked conviction and traders might be caught in a trap.

Practical Steps for Identifying Bear Traps

Step 1: Monitor Support Levels Carefully — Identify historical support where price often bounces.

Step 2: Observe Volume Patterns — Confirm that price drops are not supported by a spike in volume.

Step 3: Watch for Bullish Candlestick Patterns — Look for reversal signs like hammers or bullish engulfing candles after a dip below support.

Step 4: Wait for Confirmation — Avoid rushing to trade immediately after a breakdown; wait for price to close back above resistance or previous support to confirm a trap.

Types of Bear Traps

Fake Bear Trap

- Characteristics: A temporary break below support levels that quickly reverses.

- Example: A stock dips to $48 from $50, breaking support, but rebounds to $52, trapping short sellers.

Large Bear Trap

- Characteristics: Significant price movements in high-volume trading scenarios.

- Example: Bitcoin falls from $40,000 to $35,000 but surges to $45,000 due to institutional buying.

Psychological Bear Trap

- Characteristics: Exploits trader fear and panic, often in bearish market environments.

- Example: During a market correction, stocks briefly drop below support, triggering stop-loss orders, only to reverse sharply.

Bear Traps vs. Bull Traps: Differentiating the Traps

Bear traps and bull traps are common trading phenomena that can lead to significant losses if market signals are misinterpreted. Understanding the distinctions between these traps is critical for traders to craft effective strategies and mitigate risks.

Comparison of Bear Traps and Bull Traps

| Aspect | Bull Trap | Bear Trap |

|---|---|---|

| Market Context | Occurs during a downtrend | Occurs during an uptrend |

| Price Action | Prices rise briefly, then reverse downward | Prices fall briefly, then reverse upward |

| Perceived Signal | Signals the start of an uptrend | Signals the start of a downtrend |

| Trader Psychology | Exploits greed and hope for recovery | Exploits fear and belief in a market drop |

| Trader Position | Long positions lose money | Short positions lose money |

| Outcome | Prices reverse lower, trapping long traders | Prices reverse higher, trapping short traders |

1. Bull Trap

A bull trap happens when the price rises above a resistance level, giving a false signal of a bullish trend. Traders who buy into this breakout often face losses when the price quickly reverses downward.

- Example: Picture a stock breaking resistance at $50, enticing traders to buy. The price climbs to $52, then reverses to $45, leaving those who bought at $52 with losses.

- Market Psychology: Bull traps capitalize on optimism and the urge to chase price movements, often leading traders to make emotional decisions without proper analysis.

2. Bear Trap

A bear trap occurs when the price falls below a support level, falsely signaling the beginning of a bearish trend. Traders who sell under this assumption may face losses when the price rebounds.

- Example: Imagine a cryptocurrency falling below $30, triggering panic selling. Instead of continuing downward, it rebounds to $35, trapping traders who shorted at $30.

- Market Psychology: Bear traps exploit fear and pessimism, prompting traders to act prematurely on negative signals without waiting for confirmation.

Case Studies: Real-World Examples of Bear Traps

1. Bitcoin Bear Trap (May 2021)

- Scenario: In May 2021, Bitcoin’s price plummeted from an all-time high of nearly $65,000 to around $30,000. This sharp decline prompted many investors to panic-sell their holdings, fearing further losses.

- Outcome: Shortly after hitting the $30,000 mark, Bitcoin’s price rebounded to nearly $40,000 within a few weeks. Those who sold during the panic missed out on significant potential profits as the market recovered rapidly, exemplifying a classic bear trap scenario in the cryptocurrency market

2. GameStop (GME) Short Squeeze (January 2021)

- Scenario: GameStop became a focal point in early 2021 when institutional investors heavily shorted the stock due to perceived long-term business challenges. As the stock price began to decline, many retail investors joined in selling their shares.

- Outcome: Contrary to expectations, a massive buying frenzy led by retail investors caused GME’s price to skyrocket, trapping short sellers who were forced to cover their positions at losses. This situation not only resulted in significant financial losses for many but also sparked Congressional hearings regarding market manipulation

3. AdvisorShares Pure Cannabis ETF (YOLO) (July 2023)

- Scenario: The AdvisorShares Pure Cannabis ETF experienced a noticeable decline beginning in December 2022, with bearish signals indicating further drops. In July 2023, the ETF displayed a bearish engulfing pattern that suggested continued downtrends.

- Outcome: Contrary to these indicators, the ETF’s price unexpectedly surged shortly after the bearish signals, catching short sellers off guard and marking a shift to a bullish phase. This instance highlights how misleading signals can lead traders into bear traps